Charleston Regional Business Journal - BizWire

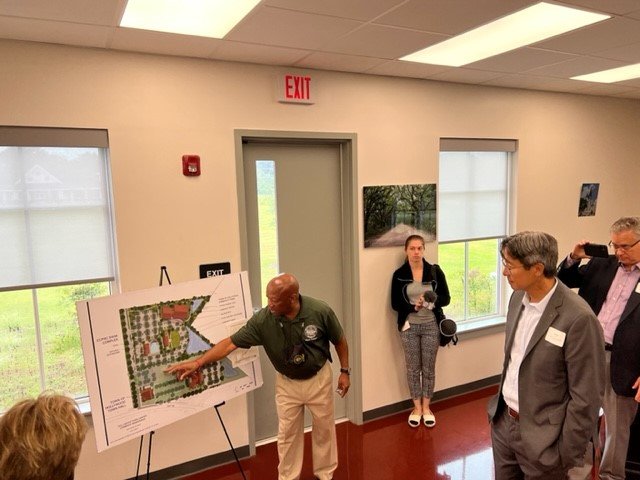

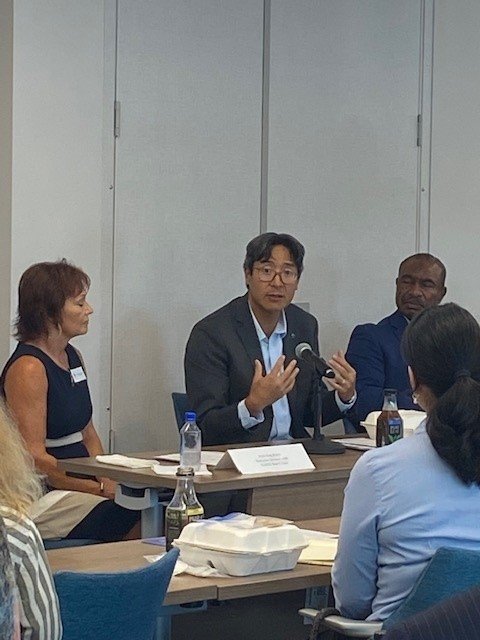

CHARLESTON, S.C. — Acting Comptroller of the Currency, Michael Hsu, today visited rural communities of the South Carolina Lowcountry as well as North Charleston to meet with community stakeholders and local businesses to discuss community reinvestment needs and opportunities. President & CEO of the South Carolina Association for Community Economic Development, Bernie Mazyck, led the Acting Comptroller on a tour of Lowcountry to learn about successful examples of community reinvestment and encourage more lending, investment, and banking services in local businesses and nonprofits.

The community tour included stops at Boogie’s BBQ restaurant in Hollywood and Sea Island Comprehensive Health Care Cooperative in Johns Island. The tour also included a visit to an artisan beverage company, Estuary Beans and Barley, on Johns Island, founded and led by Army veteran and local entrepreneur and nonprofit leader Scott Harrison. The tour concluded with a lunch and roundtable bringing together over 40 bankers, community leaders, business owners, and government officials to discuss the reinvestment and banking services needs of the community.

WCBD News 2

Michael Hsu, who serves as the Acting Comptroller of Currency, visited several locations throughout Charleston County Friday, where he spoke with local administrators and business owners about financial needs in the Lowcountry.

“To come here and to really talk to folks directly,” Hsu said, “makes a really, really big difference. That’s really, really impactful.”

Click here to view full article.

The Post & Courier

On his first trip to Charleston, Hsu said it was important to leave Washington, D.C., to get out in the field and hear on-the-ground challenges and how his agency can help.

“There is a lesser degree of (financial) security in rural areas,” Hsu said. “Anytime there is change, there are also some distinct opportunities. How do you preserve the character of the rural area and how do you make it equitable? Access to credit makes a big difference.”

Click here to view full article.